Rising FDI in Latin America

More on:

The UN Economic Commission for Latin America and the Caribbean (ECLAC) released its report on foreign direct investment (FDI), with generally good news for Latin America. While 2010 investment worldwide was fairly flat (and fell in developed economies), it soared forty percent in the region – reaching nearly $113 billion. Of the just over a trillion in worldwide flows, Latin America captured a tenth of the total (and over twenty percent of that invested in emerging economies).

These investments were divided between natural resources, domestic market players, and outsourcing venues. Within the region the biggest winners were Brazil (nearly doubling to $48.5 billion), followed by Mexico ($17.7 billion) and Chile ($15.1 billion). And, according to ECLAC, the trend is set to continue – it expects FDI to the region to rise a further fifteen to twenty-five percent in 2011.

A few interesting trends jump out of the data. One is the geographic pull of the Southern Cone. While investment in Mexico and Central America increased, the real upswing occurred in South America—almost four times as much. Brazil and Chile gained the most, but Peru, Bolivia and Argentina all saw large inflows. Only in the Caribbean did FDI actually fall.

You also see quite stark differences in the type of investment. In South America nearly a majority of FDI poured into natural resources—oil, gas, copper, iron, and soya. Further north, a greater share of the money went into manufacturing. There the biggest winners were Mexico, Panama, Costa Rica, and the Dominican Republic – all countries with free trade agreements with the United States (NAFTA and CAFTA). These trends, if they continue, suggest long-term structural economic differences may develop between the north and the south of the hemisphere.

The report also provides some context for the much-touted (and in some quarters much feared) rise in Chinese investment. It has indeed increased: last year China invested twice as much in Latin America as it did over the previous two decades combined. Directed almost solely at natural resources, it is also geographically concentrated, with most going to just three countries – Brazil, Argentina and Peru.

But the data reveals that China is still just the third largest investor -- behind the U.S. and the Netherlands (the latter’s investment bumped up significantly last year due to Heineken’s acquisition of Mexico’s FEMSA brewery). Interestingly, China trails the combined Latin American investment in the region. Taken together, multilatina outlays hit a record $43 billion - almost triple China’s $15 billion contribution. These investments were more apt to go into financial services, retail, and utilities – value-added activities with more positive trickle down effects for the broader economy. This suggests Latin American nations should be more enthusiastic about trade missions from their neighbors than from China.

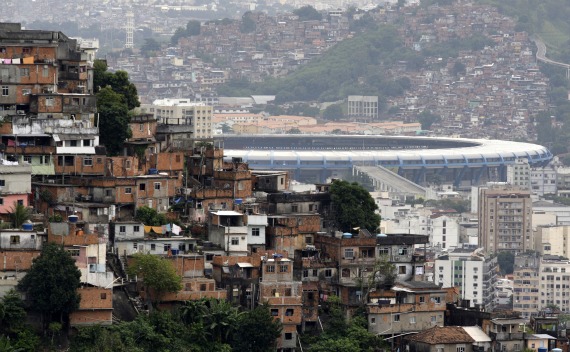

The report also hints at the hurdles the region continues to face. The proportion of investment in high tech fell far short of its global competitors—only eight percent compared to fifty-two percent among the Asian Tigers—and limited mostly to Brazil and Mexico. The region has a lot to do to upgrade educational systems and its workforce in general to change this balance.

And, with the exception of perhaps some smaller island economies, FDI isn’t going to be the ticket to the big time. It can’t make up for domestic savings and investment. In the end, growth will have to come from home. Nevertheless, these flows can provide a leg up if these nations can translate this investment into productive growth.

More on:

Online Store

Online Store